#My business account cra login update

How do I update my Multi-factor authentication settings?.Can I use a VoIP service with Multi-factor authentication?.Will I need to keep a copy of the Passcode Grid?.What if I don't have access to text message or a landline?.Can I receive help by replying to the Multi-factor authentication one-time passcode sent by SMS?.How do I re-enable the option to receive a one-time passcode for Multi-factor authentication via SMS?.Can I stop getting Short Messaging Service (SMS) messages for CRA's Multi-factor authentication?.Can I disable the Multi-factor authentication feature?.Can I use an international telephone number to receive one-time passcode with Multi-factor authentication?.Can I receive my one-time passcode by email for Multi-factor authentication?.What if I didn't receive my one-time passcode?.How do I use the Multi-factor authentication feature to access my CRA sign-in service?.Why do I now need to enter a one-time passcode to access my online account?.This will allow a taxpayer to view his tax return status, RRSP deduction limit and details of benefit payments. Quick Access requires the Social Insurance Number, date of birth and information from the last filed tax return. Some information is available to individuals without a user ID and password. Taxpayers may also grant authorization by completing form T1013 and sending it to their Tax Centre.

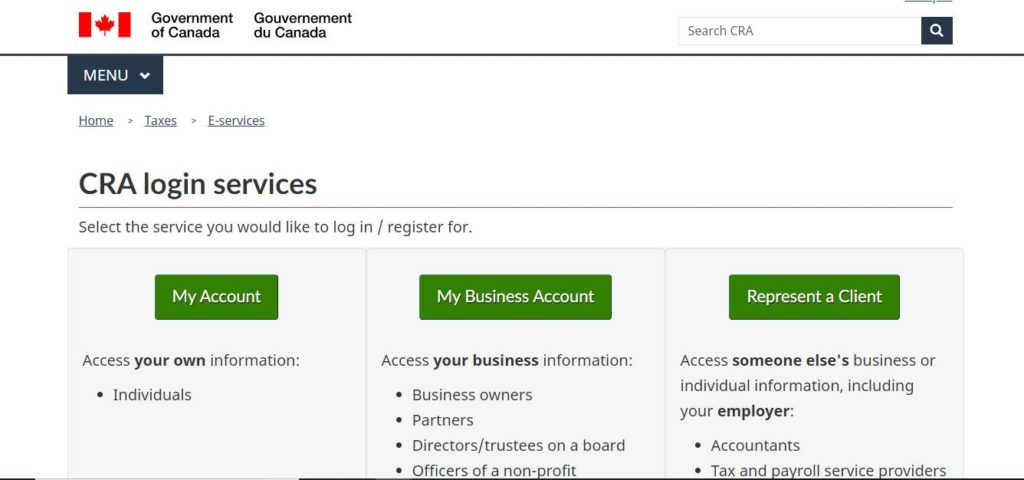

Representatives will be authorized when the taxpayer who is granting access logs on to My Account for Individuals or My Business Account and enters the Rep ID, Group ID or Business Number of their chosen representative. Examples of representatives include accounting firms, payroll services, tax preparers, financial planners, lawyers, executors, guardians and those holding a power of attorney. Represent a Client permits an individual or a business to be granted online access to the tax information of another individual or business. This year there are three new features: an instalment payment calculator, electronic transmission of accounting data (for audit purposes), and closure requests for payroll accounts.

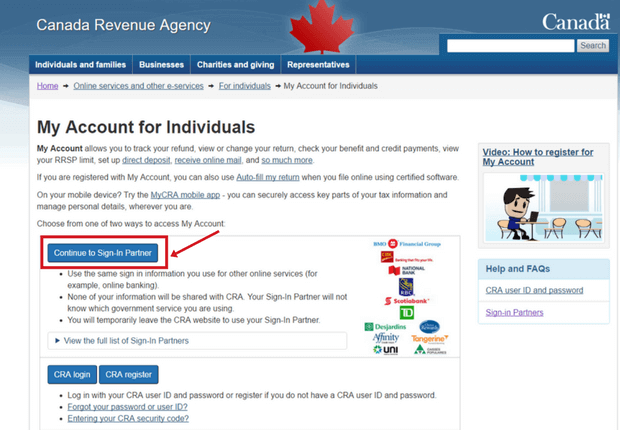

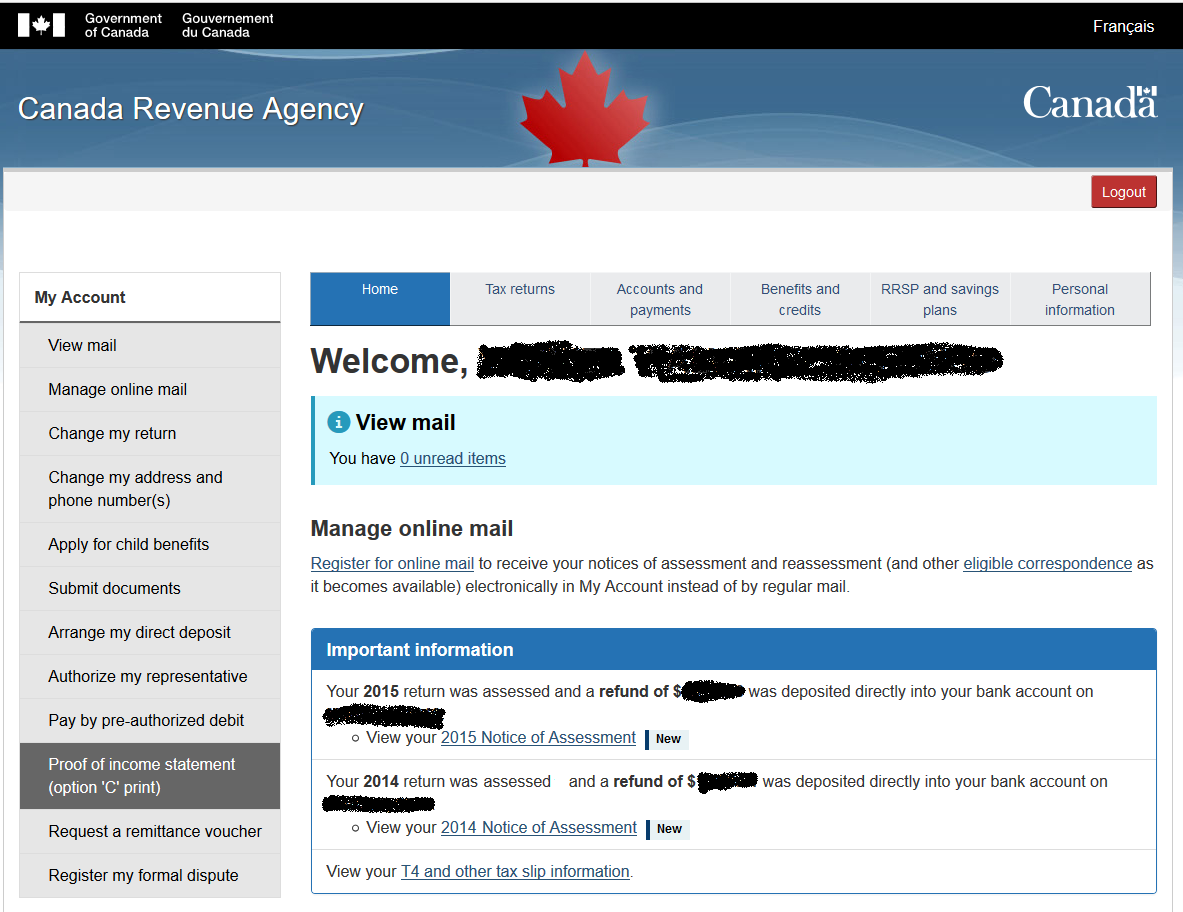

My Business Account allows business owners or their representatives to view and manage CRA accounts including GST/HST, payroll and income tax. Individuals can use My Account for Individuals to make changes to tax returns, update contact information, authorize or cancel representatives, set up payment plans, arrange for direct deposit and dispute an assessment. It also makes it possible to manage accounts online. My Account for Individuals allows taxpayers to access a wealth of personal data including tax slips for E.I., OAS and CPP, payment information for certain tax benefits, account balances, tax owing and refunds, and installment records. Those who don't have their security questions on file or who are seeking to log-in for the first time will have to complete a new registration. Taxpayers will need the five security questions and answers that they used to set up with the epass system. However, CRA indicates that everything will be up and running by February 14, 2011. Some services normally accessed will not be immediately available due to this transition. Taxpayers who had an epass can transition their account to the new system now. This change applies to My Account for Individuals, My Business Account and Represent a Client.

#My business account cra login password

Get your User ID and Password at CRA: Account Access ChangesĬanada Revenue Agency allows online access to tax information for individuals, business owners and their representatives. But, as of October 4, 2010, CRA has replaced its epass service with a new, secure log-in system requiring a user ID and password.

0 kommentar(er)

0 kommentar(er)